Over a third of broker firms (37%) believe market conditions are currently improving, compared to 28% in July 2012 and 14% in January 2012.

Mortgage availability is also much improved from the early part of last year. While 80% of firms were unable to secure a mortgage for one or more standard borrowers in the three months leading up to January 2012, and 79% in July, only 63% reported the same issue in January 2013.

However, brokers’ expectations for gross lending in 2013 remain more conservative than the wider industry. IMLA members – representing over 80% of lending to the intermediary market – anticipate a total of £150bn (CML – £156bn), while intermediaries made a more cautious estimate of £139bn.

First-time buyers earmarked for growth

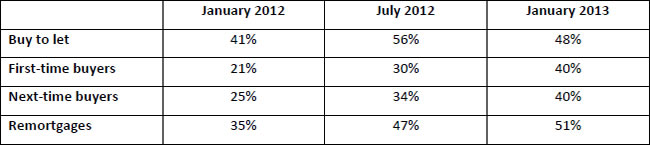

Mortgage advisers are most confident about remortgages being a source of new business, with over half (51%) predicting volumes will grow compared with over a third (35%) in January 2012. While expectations of more buy-to-let business have fallen back from 56% in July, almost half of advisers (48%) still see potential for growth in this area.

The biggest change of emphasis over the last year is in relation to first-time buyers. Almost twice as many brokers (40%) expect to see business volumes increase in this area, compared

with January 2012 (21%). First-time buyers will be helped by the anticipated stability of UK

house prices, which intermediaries expect to be approximately £162,500 in June 2013: little

more than £1,000 higher than the Land Registry figure for October 2012 (£161,605).

Percentage of intermediaries expecting to see business volumes increase

Peter Williams, Executive Director of IMLA, comments

“The economic outlook remains challenging but the future is looking up for the mortgage

market. The survey results show growing optimism, especially regarding opportunities for

first-time buyers, and intermediaries are going to play an essential role in achieving this. The

likelihood of new products appearing and strong competition between lenders means high

quality, professional advice will be invaluable for the many people looking to buy a property

or remortgage an existing home in 2013.

“It is extremely encouraging that brokers are experiencing fewer barriers to finding a

suitable product for standard consumers. Perhaps the strongest sign of renewed confidence

is the fact that more than half of brokers (53.7%) expect the intermediary market to account

for 60% or more of all mortgages sold this year.

“Although the Financial Services Authority (FSA) has toned down the Mortgage Market

Review’s (MMR) proposed ban on execution-only sales, some have already moved to end

non-advised mortgage transactions and more may follow. It is clear we will see the

relationship between intermediaries and lenders evolving further as the market adjusts to a

new regulatory environment under the Financial Conduct Authority (FCA).

“IMLA members place great value on the strength of their relationships with broker firms. In

our work over the coming months on issues such as MMR implementation and individual

registration, we will be working hard to strengthen and develop the intermediary market.”