Renewed optimism in the mortgage industry for growth in 2015 is being overshadowed by the view that the market has become ‘too conservative’ as a result of post-financial crisis regulation, according to the latest Intermediary Lending Outlook research from IMLA (Intermediary Mortgage Lenders Association).

Almost three quarters (74%) of brokers take this view, which is backed by nearly two thirds (65%) of lenders. It comes despite improving sentiment towards market conditions following a period of changes to lending criteria.

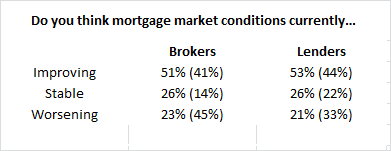

IMLA’s previous research in July 2014 found 45% of brokers and 33% of lenders reporting that market conditions were worsening. This followed the implementation of the Mortgage Market Review (MMR) in April and with new macro-prudential controls on the horizon.

Their pessimism has since softened with just 23% of brokers and 21% of lenders feeling the same way in January 2015. Over half of brokers (51%, up from 41% in July) and lenders (53%, up from 44% in July) now feel market conditions are currently improving.

(July 2014 results in brackets)

However, IMLA’s research reveals 84% of brokers were unable to source a mortgage for at least one client during the last six months, up from 78% who said the same in July 2014. The biggest difficulties have occurred in four main product areas:

• 53% of brokers were unable to help a client with adverse credit

• 53% were unable to help an interest-only borrower

• 50% were unable to help a customer seeking to borrow into retirement

• 46% were unable to help a client who was self-employed or had an irregular income

Overall, brokers and lenders both identify low income borrowers and those with dependents as the two consumer groups who have been most impacted by reduced access to finance following the MMR.

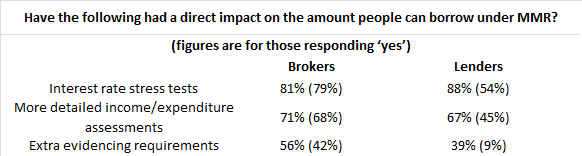

Among the new rules, interest rate stress tests are seen to have had the biggest effect in reducing the amount people can borrow. More brokers and lenders report that the new rules are having an impact than was the case in July.

(July 2014 results in brackets)

Almost two fifths of brokers (39%) feel product availability has increased following the MMR, while just 18% feel it has reduced. Yet opinion is more evenly split on product flexibility: 27% of brokers feel this has improved but 23% disagree.

Peter Williams, Executive Director of IMLA, comments

“Regulation is vital to ensure that mortgage lending is safe and in proportion to consumer needs and the wider economy. But when families with dependents are among those who find themselves at a disadvantage, there are legitimate concerns that the pendulum has swung too far as a result of successive, incremental measures.

“The market is clearly still adjusting to changes including the MMR and the Financial Policy Committee’s interventions. With the European Mortgage Credit Directive (MCD) on the horizon and the latest Basel Committee proposals, it will become even more of a challenge to understand the individual impacts of these different interventions. What’s clear is that each new layer of control squeezes more people out at the margins. As the boundaries grow tighter, we must work to avoid unintended social engineering as a result.

“Current trends suggest that owner-occupation may fall below 62% by the end of the next parliament, and there is a real need for government, regulators and industry to pause and assess the lie of the land. Efforts must focus on striking the right balance between innovation and protection to avoid frustrating people’s legitimate ambitions to own their own homes.”

For further information please contact:

Maham Uzair / William Muir, The Wriglesworth Consultancy

Tel: 0207 427 1400

Email: imla@wriglesworth.com

Notes to Editors

Methodology

The Intermediary Lending Outlook compares views from IMLA members – including senior representatives of banks, building societies and specialist lenders – and 2,164 mortgage intermediaries from across the UK on mortgage market conditions since January 2012.

Over 250 brokers were surveyed independently by Wriglesworth Research as part of the latest wave of research in December 2014 and January 2015. IMLA’s membership comprises 24 lenders and accounts for over 70% of mortgage lending via intermediaries.

About IMLA

The Intermediary Mortgage Lenders Association (IMLA) is the trade association that represents mortgage lenders who lend to UK consumers and businesses via the broker channel. Its membership of 52 banks, building societies and specialist lenders include 18 of the 20 largest UK mortgage lenders (measured by gross lending) and account for about 90% of mortgage lending (91.6% of balances and 92.8% of gross lending).

To keep up to date about IMLA in the news, our reports and other announcements, follow us on LinkedIn.