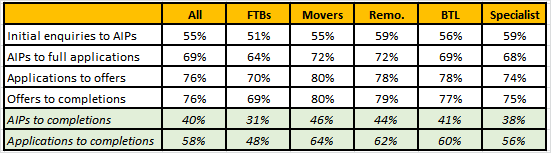

The tracker – using data from BDRC Continental – examines applicants’ journey through the intermediary channel from their initial mortgage enquiry¹ through to completion. The Q1 edition splits out the results by firms dealing with first-time buyers (FTBs), homemovers, remortgagers, buy-to-let (BTL) borrowers and applicants for specialist loans.²

It shows intermediaries dealt with an average of 49 new enquiries, with those focused on FTBs and homemover segments being kept busiest (55) followed by those doing BTL business (52).

Overall, 55% of enquiries in Q1 progressed to an agreement in principle (AIP), with the highest rate reported by intermediaries dealing with remortgages and specialist loans (59%). Those focused on FTBs saw the fewest initial enquiries (51%) progress any further.

This is likely to be influenced by a number of factors, including: affordability constraints; some aspiring borrowers making initial enquiries without looking to progress immediately; and others shopping around and exploring their options via multiple firms or channels.

Industry data on loans via intermediaries also points to seasonality as a factor. Both 2014 and 2015 saw FTB activity make a slower start to the year than homemover and remortgage activity, before registering the fastest growth of all three segments from Q1 to Q2.³

IMLA’s data therefore highlights the potential for further growth in FTB activity this year, with demand continuing and FTB loans via intermediaries already up 15% year-on-year in Q1.⁴

Homemovers most likely to progress to application stage and beyond

Overall, almost seven in ten (69%) AIPs in Q1 progressed to an application, rising to 72% among firms handling homemover and remortgage cases. These higher rates may be a sign of these borrowers having a firmer idea of their needs and an immediate wish to progress.

More than three in four (76%) applications received an offer, and the same percentage of offers (76%) resulted in a completion. In each case, intermediaries dealing with homemover cases reported the highest conversion rates (80%).

Comparing types of firm, members of Appointed Representative (AR) firms reported a 78% progress rate at both stages, compared with 73% among Directly Authorised (DA) businesses.

According to brokers, lender decisions to decline an application in Q1 accounted for fewer than three in ten (28%) drop-outs between AIP and completion stage, notwithstanding the option for those affected to keep progressing their application via another lender.

Almost three quarters of drop-outs (72%) occurred for reasons other than lender declines. Intermediaries dealing with first-time buyers reported a lower rate of lender declines (29%) than those dealing with homemovers (31%) or applicants for specialist loans (33%).

Summary table: Borrowers’ progress through the intermediary channel, Q1 2016

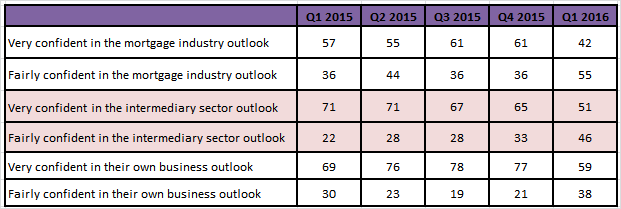

The Tracker also examines business confidence among intermediary firms in the first quarter of 2016. While the overwhelming majority remain confident about the future outlook, the data suggests a greater level of caution than at any point in the previous 12 months with more brokers reporting they are ‘fairly’ rather than ‘very’ confident.

Intermediary confidence – Q1 2015 to Q1 2016

¹ For the purposes of this research, an enquiry is defined as any expression of interest by a borrower in exploring the mortgage products available to them.

² This includes adverse credit mortgages, equity release mortgages or self-build mortgages.

³ Data from the Council of Mortgage Lenders shows the volume of FTB loans via intermediaries grew 34% from Q1 to Q2 2014 (vs. 32% for homemovers and 6% for remortgages), and by 26% from Q1 to Q2 2015 (vs. 22% for homemovers and 7% for remortgages).

⁴ Data from the CML shows a 15% annual increase in intermediary FTB loans in Q1 2016 to 50,100, from 43,700 in Q1 2015.

Peter Williams, Executive Director of IMLA, comments, comments

“Using an intermediary has become ever more established as the most common way to access mortgage finance in the UK. After a busy start to the year, this data suggests that homemovers, in particular, have taken advantage of strong competition between lenders and a fast expanding range of competitive products.

“The first time buyer market typically picks up pace in Q2, although April’s stamp duty reforms have clearly disrupted normal patterns and will have a lingering effect on the supply of property. Credit conditions are just one of many factors impacting first time buyers’ journey from enquiry to completion, and the EU referendum adds another unknown into the mix for Q2 which won’t go unnoticed in terms of intermediary confidence and consumer behaviour.

“In the meantime, despite the rush to beat the stamp duty reforms, our analysis also suggests there was no opening of the floodgates for BTL mortgages, with the progress of BTL applications remaining broadly in line with market norms. This suggests that standards of borrower assessment have held up well, despite the pressure of extra demand.

“As the new index develops, we will be able to track how these flows fluctuate over time and gain insights into how efficient and effective the mortgage process is.”

For further information please contact:

Andy Lane / Tora Turton / Maham Uzair / Will Muir, Instinctif Partners, 020 7427 1400

twc.imla@instinctif.com

Notes to Editors

Methodology

The IMLA Mortgage Market Tracker uses data provided by BDRC Continental – the UK’s largest independent research consultancy – as part of its established Project Mercury, a continuous monitor of intermediary lender marketing effectiveness and broker sentiment since 2007.

The Q1 2016 findings are based on interviews between January and March with 300 intermediaries who are located in Great Britain, arrange a minimum of 24 mortgages per annum and are not tied wholly to a single lender. Findings are weighted by firm size and type to be representative of the intermediary sector.

Adjustments to the methodology since the pilot edition (Q3 2015) mean comparisons should not be made prior to Q1 2016. Future editions of the IMLA Mortgage Market Tracker will include tracking data to monitor changes in market conditions.

About IMLA

The Intermediary Mortgage Lenders Association (IMLA) is the trade association that represents mortgage lenders who lend to UK consumers and businesses via the broker channel. Its membership of 52 banks, building societies and specialist lenders include 18 of the 20 largest UK mortgage lenders (measured by gross lending) and account for about 90% of mortgage lending (91.6% of balances and 92.8% of gross lending).

To keep up to date about IMLA in the news, our reports and other announcements, follow us on LinkedIn.