The value of specialist mortgage lenders’ annual lending has grown by 19% per year since 2009, according to a new report from the Intermediary Mortgage Lenders Association (IMLA). Specialist lenders have seen the total value of their lending increase to £17bn per year in 2016 – more than a threefold increase from the low base of £5bn recorded in 2009*.

The report suggests that specialist lenders are now in a position of strength following the market’s turbulent past, and are effectively catering for the growing number of ‘non-standard’ borrowers in the UK who fall outside mainstream lenders’ criteria.

Highs and lows

Specialist lenders first came to prominence in the 1980s in the wake of the financial deregulation enacted by the Thatcher government. They were characterised as having no branches and relied exclusively on introductions for business and wholesale markets for funding. In the 1990s, the sector became focused on niche areas such as buy-to-let. This contrasts with the ‘big’ lenders – or Monetary Financial Institutions (MFIs) as termed by the BoE– whose deposits fund their lending, and have a greater focus on the mainstream.

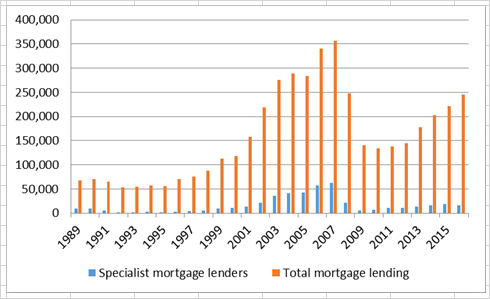

In the past specialist lenders have seen their market share both increase and decrease sharply on two occasions. In the late 1980s the segment saw its market share reach as high as 14%, before the effects of high interest rates and the housing downturn squeezed the markets they focused on in the 1990s*. Similarly, specialist lenders bloomed again in the late 1990s as the housing market and wider economy recovered, before falling away during the recession.

The impressive growth since the financial crisis is largely a result of serving niche market segments that have received proportionately less attention from the mainstream lenders – and whose appetite to deviate away from lending to ‘standard’ borrowers was reduced due via the tougher regulation ushered in in the wake of the financial crisis, and which made the process more complex for large institutions. This provided specialist lenders with the opportunity to rebuild their presence in the market through their flexibility and innovation, maintaining substantially higher margins, as the difference between prime and niche mortgage rates has been substantially higher in this new environment.

Four key products have been the staple of specialist lenders’ business during these growth years. Buy-to-let mortgages, specialist residential mortgages, bridging loans and second charge mortgages have all been dominated by specialist lenders since the recession, with the rapidly expanding and maturing buy-to-let market proving particularly fruitful.

Chart 1: Mortgage lending by specialist lenders†

A firmer footing for the future

IMLA’s report suggests the outlook for specialist lenders is positive, with market and economic conditions meaning demand from ‘non-standard’ borrowers is likely to remain buoyant, with specialist lenders well-equipped to provide the finance they need.

Firstly, a rising share of mortgages are being sourced through intermediaries, who can scan all lenders for the most appropriate loan for a customer based on price, suitability and security, rather than brand. This gives even the newest mortgage brands the opportunity to compete with the entire intermediated market.

Additionally, IMLA highlights that specialist lending levels are way below those of the pre-financial crisis era, suggesting that there is substantial unmet demand. The number of self-employed people has increased to 4.8 million people in the UK&dagger, and there were a record 912,000 county court judgements issued against consumers in England and Wales‡ which may limit people’s access to mainstream lending in future, even if they have rehabilitated their finances. Such data is suggestive of this growing market and for the opportunities for specialist lending to borrowers with ‘non-standard’ needs.

Specialist lenders are also in a stronger position to weather future economic turbulence and downturns. While higher regulatory capital requirements have disadvantaged most specialist lenders relative to the large banks and building societies, they have also underpinned the sector with more stability. Specialist borrowers are also subject to the same stringent affordability checks as borrowers across the whole market, but manual underwriting allows specialist lenders to take borrowers’ personal circumstances into account, providing greater flexibility.

*Bank of England, includes specialist subsidiaries of deposit takers

†ONS – UK labour market statistics, March 2017

‡Registry Trust, February 2017

Peter Williams, Executive Director of IMLA, comments

“Specialist lenders have enjoyed strong growth since the end of the recession, largely through their focus on classically niche, less well-served areas of the market. Mortgages are not ‘one size fits all’ products and as such the number of borrowers with ‘non-standard’ needs is increasing. Through innovation and flexibility, combined with strong underwriting standards, specialist lenders have capitalised on the growing demand for products like specialist residential and lifetime mortgages.

“The growth of these lenders has been good for consumers too. It is important that mortgage finance is available to a broad range of borrowers, and by serving ‘non-standard’ areas of the market, specialist lenders are supporting inclusiveness while holding true to today’s strict affordability criteria.

“There is strong evidence to suggest that specialist lenders can now break the cycle that has defined the segment in the past. The range of borrowers who qualify for a mortgage on standard mainstream terms will remain restricted, and the mortgage market is also becoming increasingly intermediated.”

For further information please contact:

Fran Hart / Will Muir / Amy Boekstein, Instinctif Partners

Tel: 0207 427 1400

twc.imla@instinctif.com

Notes to Editors

About IMLA

The Intermediary Mortgage Lenders Association (IMLA) is the trade association that represents mortgage lenders who lend to UK consumers and businesses via the broker channel. Its membership of 52 banks, building societies and specialist lenders include 18 of the 20 largest UK mortgage lenders (measured by gross lending) and account for about 90% of mortgage lending (91.6% of balances and 92.8% of gross lending).

To keep up to date about IMLA in the news, our reports and other announcements, follow us on LinkedIn.