The IMLA report – ‘The New Normal: Prospects For 2019 and 2020’ – forecasts that while the mortgage market will remain flat in 2019, millions of people will still be waiting for their chance to be able to own a home for the first time after a decade of Britons remaining ‘missing’ from the homeowner market.

Within the report, IMLA assesses the past and future of the UK mortgage market by determining latest lending practices for first-time buyers, home movers and landlords, as well as outlining the state of mortgage funding and future lending trends over the coming two years.

IMLA estimates that nearly five million borrowers would have been expected to buy their first homes since the financial crisis, but only 2.5 million people became first-time buyers since 2008. This means more than 2.4 million Britons have yet to make their first step onto the housing market.

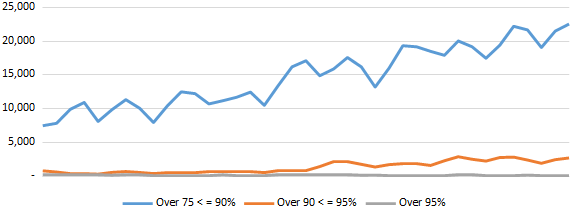

Comparison of actual first-time buyers and the expected number of first-time buyers, based upon population increases, 1996–2017

Source: House of Commons Library, ONS

Further, when the net number1 of people entering owner occupation is broken down generationally, IMLA’s analysis suggests that whereas 449,000 35-54 year-olds entered owner occupation between 1996 and 2006 in net terms, owner occupation among the following cohort of 35-54 year-olds fell by 57% between 2006 and 2016 to just 191,000.

| Age | 1996–2006 | 2006–2016 | Estimated shortfall | Shortfall percent |

|---|---|---|---|---|

| 16–34 | 2,961,000 | 1,854,000 | -1,314,270 | -37% |

| 35–54 | 449,000 | 191,000 | -271,470 | -57% |

| 55+ | 1,690,000 | 1,947,000 | (+223,600) | (+15%) |

IMLA’s report notes that although low mortgage rates are supporting borrower affordability, high house prices and regulatory constraints on lending post-crisis, such as the need to stress interest rates against significant future increases to determine affordability, as key reasons for difficulties in borrowers moving onto and up the housing ladder.

A steady market ahead in 2019

A significant jump in lending would be required to help those who are still waiting to get onto the housing ladder, but IMLA predicts that this will be unlikely this year or next as the mortgage market is set to remain steady in the face of wider economic uncertainty.

According to the report, 2019 gross mortgage lending will total £269 billion, broadly unchanged from 2018’s level. And, while remortgaging has been the main driver of increased lending over the past few years, IMLA predicts remortgaging will also be broadly stable at £102 billion in 2019 as the popularity of product transfers continues to grow.

Looking forward, given the flat picture in the housing market and the underlying shift from remortgage activity to product transfers as seen in 2018, IMLA expects a slight dip in both lending and remortgaging in 2020.

Controlled risk appetite

With a need for more lending options for those trying to get onto the housing ladder, the New Normal report suggests that, due to a broad downward trend in mortgage lenders’ spreads, lenders have been encouraged to look to higher LTV lending to maintain profitability.

The report also notes that the marginal cost of high LTV lending is falling, reflecting the strong credit performance of high LTV business written since the financial crisis. It also found that high LTV lending over the past five years shows exceptionally low arrears by historical standards, making high LTV lending more attractive as future loss rates on such business reduce.

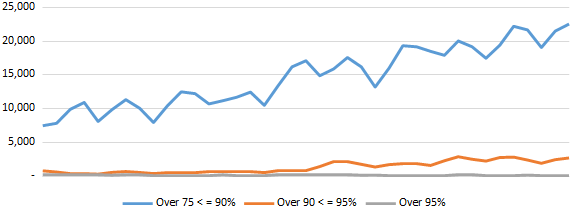

That said, IMLA found that while there has been a sustained increase in lending over 75% and up to 90% LTV, lending above 90% LTV still remains very subdued, not surpassing 5% of total lending in any quarter since the financial crisis.

Quarterly lending volumes

Source: FCA MLAR data

Subdued buy-to-let to remain on even keel

Landlords are finally feeling the effects of the 2015 adverse regulatory changes, which IMLA forecasts will be a major reason for a lacklustre buy-to-let sector in 2019 and 2020. The report predicts that gross buy-to-let lending will fall 6% to £36 billion in 2019 and £35 billion in 2020, with landlords purchasing 59,000 rental properties in the coming year, down from 66,000 in 2018.

Intermediary power to increase

While the market will remain flat, IMLA notes that lending via intermediaries will increase as more borrowers seek expert advice to navigate a tough market. Mortgage brokers undertook 74% of mortgage lending by volume in 2018, the highest share on record, and IMLA expects this trend to continue. The report notes that intermediary lending will rise to £169 billion in 2019, and £171 billion in 2020, as the share of lending introduced by intermediaries rises to 75% in 2019 and 76% by 2020.

1 Net number entering owner occupation is derived by calculating the number of people entering owner-occupation subtracted by those leaving it.

Kate Davies, Executive Director of IMLA, comments

“We have had a robust recovery in lending volumes since the low of 2010, and the continuing combination of steady inflation and low unemployment should underpin the housing and mortgage markets in 2019 and 2020. Intermediary-driven lending continues to go from strength-to-strength as more people than ever turn to a broker to find the most suitable mortgage.

“But the mortgage market isn’t fully functioning as one would expect. Record low rates and historically low loan-to-value (LTV) ratios, coupled with cash and household equity being injected into the housing stock, are more usually associated with a continuing period of recession.

“These are symptoms of a market that has failed to support first-time buyers and those moving up the housing ladder in the way it did for previous generations. Although low mortgage rates are supporting borrower affordability, high house prices and regulatory constraints on lending make it harder for borrowers to move onto the housing ladder.

“With the mortgage market now following a gentle trajectory, it is a good time for policy-makers and regulators to reassess the costs and benefits of the present regulatory structure, recognising that the impact on those locked out of homeownership can be considerable and lasting.”

Lee Jones / Andrea Borbely, Instinctif Partners

Tel: 0207 427 1400

Email: imla@instinctif.com

Notes to Editors

About IMLA

The Intermediary Mortgage Lenders Association (IMLA) is the trade association that represents mortgage lenders who lend to UK consumers and businesses via the broker channel. Its membership unites 43 banks, building societies and specialist lenders, including 16 of the top 20 UK mortgage lenders responsible for almost £180bn of annual lending.*

IMLA provides a unique, democratic forum where intermediary lenders can work together with industry, regulators and government on initiatives to support a stable and inclusive mortgage market.

Originally founded in 1988, IMLA has close working relationships with key stakeholders including the Association of Mortgage Intermediaries (AMI), UK Finance and the Financial Conduct Authority (FCA).