Nearly 200,000 owner occupier housing transactions in England are now made by the over-55s as a growing number use their huge equity reserves to find their perfect last home, according to the latest report from the Intermediary Mortgage Lenders Association (IMLA).

The report—‘Last-Time Buyers: the challenges and opportunities for 55+ homeowners wanting to move’ the relatively undocumented growing trend of older homeowners predominantly using cash to move from their established family home. It found that the number has roughly doubled over the past decade.

The report notes that each year only around 2.5% of the eight million older homeowners in England move. But it predicts that, as the cohort of over-55s swell faster than all other generations over the coming decades, more people will seek to make one final housing transaction.

Cash is king for over-55s

According to estimates1, property turnover has halved over the past 25 years and transactions continue to run at only about three-quarters the pace before the credit crisis. The picture would have been a lot bleaker had it not been for much higher activity from LTBs.

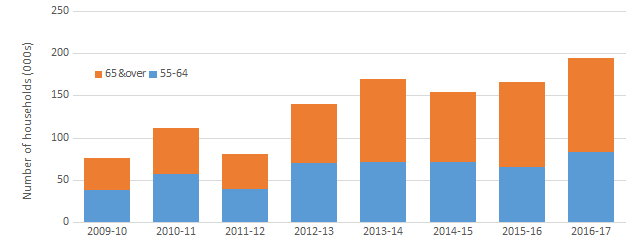

Chart 1: Older households’ (55+) owner-occupation purchases in England, 2019–2017

Source: English Housing Survey

A majority of older homeowners—63%—own their property outright, and they account for the bulk (84%) of all outright owners2, holding a disproportionate share of housing equity—£1.8 trillion out of a total £2.6 trillion3. Much of this equity is likely fuelling LTBs—in 2016/2017 LTBs in England accounted for nearly all of the moves (132,000) by outright owners (138,000), which were up 20% overall since 2006/2007 (115,000)4.

This strongly suggests that most LTB activity, and much of the growth in that activity, has to date been cash-financed, a phenomenon which has remained relatively hidden as many commentators focus only on mortgage transactions to assess the housing market.

LTBs lack suitable housing options

While LTBs currently account for a small percentage of the 55+ home-owning population, 47% of the homeowners over 55s5, representing about four million households, plan to downsize at some stage. Another study6 suggests that there are 3.1 million last-time buyer households looking to downsize, and that this is set to grow to 3.7 million by 2026.

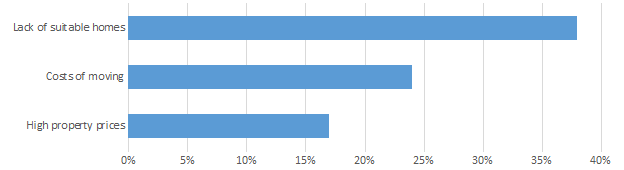

A wide array of factors serve to hold back LTB activity, but prominent among them are poor choice of suitable properties to buy, high transaction costs and affordability pressures.

Chart 2: Reasons why downsizing is not more popular among older homeowners

Source: Prudential

IMLA’s report found that relatively few older homeowners actually need to move for health or other personal reasons, and for the vast majority any move is aspirational in nature and focused on the mainstream housing market. And, although there is some preference on the part of older people to move to a smaller and/or a cheaper home, there is a wide spectrum and not insubstantial numbers of older homeowners looking to move in the opposite direction.

1 HMRC; ONS; IMLA estimates

2 The mortgage market today—FCA analysis of an evolving sector, FCA, February 2019

3 Equity release rebooted: the future of housing equity as retirement income, Equity Release Council, April 2017

4 English Housing Survey, MHCLG, July 2018

5 Nearly 4 million plan to downsize, Prudential, September 2017

6 Last Time Buyers, Legal & General, April 2018

Kate Davies, Executive Director of IMLA, comments

“Our increased life expectancy and growing number of people aged 55+ means that, far from being a niche sector, the number of LTBs in England has doubled within a decade. It’s clear that there is much appetite among older homeowners to move into a property better geared to their needs in later life – whether that be in terms of preferred location, character or size, but they face a number of headwinds in achieving that.

“It is curious that house-builders appear to have been slow to recognize what could be a sizeable market for a variety of designs that combine practicality, low maintenance and energy efficiency. Retirement developments aimed at senior citizens have their place, but they’re not appropriate for everyone.

“From a lending perspective, we have already seen considerable financial innovation around mortgages into retirement, lifetime mortgages and retirement interest-only products. But there is much more that could be done in fostering LTB schemes, whether these are bespoke equity loan deals, shared ownership schemes or entirely new arrangements.

“It may also be time for the Government to address this LTB policy blind spot and begin to work more closely with the lending and house-building sectors to kick-start activity, much as it did for first-time buyers with its Help to Buy initiatives.

“With demographic-led demand set to increase, it is hard to avoid the conclusion that we need to unblock new supply and develop new models of housing that cater for mainstream LTBs. We see huge opportunities for the housing and mortgage sectors to better serve the interests of older homeowners over the coming years, and in ways that promote their lifestyle and well-being, as well as the wider health of the housing market.”

Lee Jones / Andrea Borbely, Instinctif Partners

Tel: 0207 427 1400

Email: imla@instinctif.com

Notes to Editors

About IMLA

The Intermediary Mortgage Lenders Association (IMLA) is the trade association that represents mortgage lenders who lend to UK consumers and businesses via the broker channel. Its membership unites 42 banks, building societies and specialist lenders, including 16 of the top 20 UK mortgage lenders responsible for almost £180bn of annual lending.*

IMLA provides a unique, democratic forum where intermediary lenders can work together with industry, regulators and government on initiatives to support a stable and inclusive mortgage market.

Originally founded in 1988, IMLA has close working relationships with key stakeholders including the Association of Mortgage Intermediaries (AMI), UK Finance and the Financial Conduct Authority (FCA).